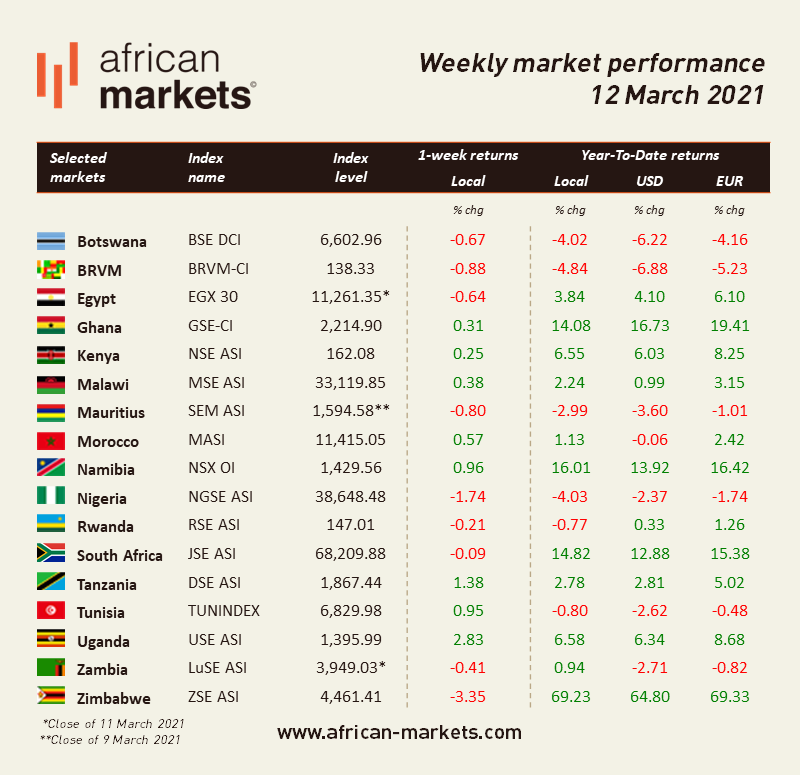

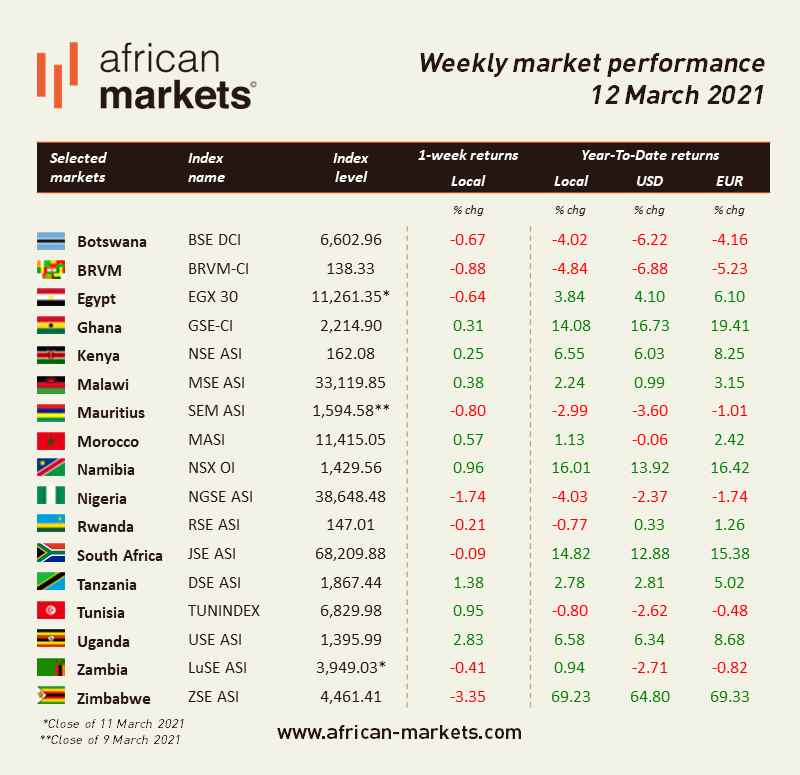

Overall sentiment on African equity markets was mixed. Among the markets we cover, 9 of them retreated this week while 8 advanced. Uganda led the pack as equities in Kampala jumped 2.83% and are up 6.58% so far this year. Conversely, Zimbabwean equities lost 3.35% over the 5-day period but remain up 69.23% YTD.

West Africa

BRVM – Bears set the tempo on the Western Africa regional exchange. The Composite Index lost 0.88% in a thinly traded week that saw only XOF 277m (USD 0.50m) worth of shares change hands every day on average. This is in line with the daily average turnover of the week before. The market is down 4.84% year-to-date and the total market capitalization stands at XOF 4,163bn (USD 7.6bn). The top performer this week is the BOA Senegal. The stock jumped 12.92% over the 5-day period is up 0.33% since the start of the year. The market heavyweight, Sonatel, closed the week at XOF 12,200, down 5.24% over the week. Shares in the telecom operator are down 9.63% year-to-date.

NGSE – Bears maintained their hold on equities in Lagos. The benchmark index of the Nigerian stock exchange declined for the sixth-straight week closing on Friday at 38,648.48, down 1.74% WoW. YTD returns moved further into negative territory in local currency (-4.03%). Rising yields in the fixed income space continued to weigh on investor sentiment. Activity remained strong this week as NGN 4.7bn (USD 12.36m) worth of shares was traded on average over the last five days. The total market capitalization stands at NGN 20.2tn (USD 53.1bn). The top performer this week is Champion Breweries. Shares in the brewer jumped 42.86% and are now up 183.72% YTD. Dangote Cement, on the other hand, remained flat and closed the week at NGN 220. The shares in the cement producers are down 10.17% YTD.

On the other hand, the Nigerian Stock Exchange has finally completed this week its demutualization process, following approval from the Securities and Exchange Commission (SEC) and Corporate Affairs Commission (CAC); This empowers the NGSE to activate its Transition Plan to a new operational structure and holding company, paving the way for its listing. A new non-operating holding company known as The Nigerian Exchange Group Plc (NGX Group) was formed. It has three operating subsidiaries, namely: Nigerian Exchange Limited (NGX Limited), NGX Regulation Limited (NGX REGCO), and NGX Real Estate Limited (NGX RELCO) which have been duly registered at the CAC.

North Africa

BVC – Morrocan equities advanced this week. The MASI gained 0.57% in a week that saw MAD 74.73m (USD 8.3m) worth of shares changed hands every day on average, a 102% increase from the week before. Total market capitalization stands at MAD 590bn (USD 65.5bn), up 1.13% YTD. Disway is once again among the top performer this week. The shares in IT equipment distributors rose 7.51%. The counter is now up 25.29% YTD. The heavyweight Maroc Telecom closed at MAD 139.5 on Friday, up 1.27% WoW. The stock is down 3.79% YTD.

EGX – The Egyptian market retreated this week. The EGX 30 lost 0.64% and closed at 11,261.35 points on Thursday. Average daily turnover dropped 18% to EGP 1.22bn (USD 77.5m) and the total market capitalization amounts to EGP 688.6bn (USD 43.9bn). The benchmark index is up 3.84% so far this year. SPINALEX, the textile company, is a notable performer this week. The counter soared 20.59% over the week and is up 96.58% YTD. The Egyptian heavyweight, CIB, closed EGP 61 on Thursday, up 3.06% YTD. Note that Fawry, the listed fintech, tumbled this week to close at EGP 35.99 on Thursday, down 22.15% from last week. The counter is now up 7.37% YTD.

East Africa

NSE – Kenyan equities rallied this week. The Nairobi Securities Exchange’s benchmark index gained 0.25% WoW. Average daily turnover increased to KES 649m (USD 5.9m) and the total market capitalization amounts to KES 2,490bn (USD 22.7bn). The market is up 6.55% YTD. Liberty Kenya Holdings topped the performance board this week. The shares in the insurance company soared 19.06% WoW as the South African mother company, Liberty Holdings, announced its plans to increase ownership in its Kenyan subsidiary from 57% to 73%. The deal is subject to regulatory approval from all relevant authorities. Shares are now up 24.94% YTD. Safaricom lost some ground this week as shares in the telecom operator closed at KES 37.10 on Friday, down 0.54% WoW. The counter remains up 8.32% so far this year.

Southern Africa

JSE – South African cooled down this week as the JSE ASI shed a mere 0.09% to close at 68,209.88. The ASI declined on Friday after it reached record highs on Thursday after Biden’s stimulus package was approved by the House of Representatives. South African equities are up 14.82% so far this year. The JSE heavyweight Prosus closed at ZAR 1,807.6 on Friday. It is up 12.54% so far this year.

ZSE – Bears made their comeback in Harare. The ASI dropped 3.35%. Daily average turnover soared seven-fold to reach around ZWL 598m (USD 7.1m) and total market capitalization amounts to ZWL 553bn (USD 6.6bn). Zimbabwean equities are up 69% so far this year.

Comments