- Hasetins plans to build a 12,000-ton rare earths plant in Nigeria’s Nasarawa State

- The $400 million investment raises questions over project details and timeline

- Nigeria pushes to grow mining’s GDP share from less than 1 % to 10 % by 2026

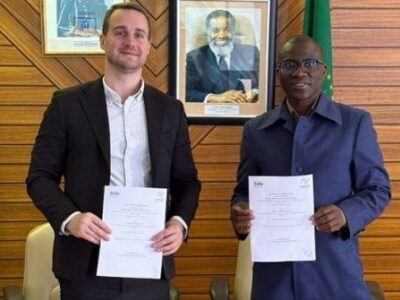

Yesterday, Nigeria announced a $400 million foreign investment deal to develop what could become Africa’s largest rare earths and critical minerals processing plant. The project, led by Hasetins Commodities Ltd, will be built in Nasarawa State, according to Minister of Mines Dele Alake (pictured).

But despite the bold claims, many key details remain unclear.

In a June 19 statement, Hasetins said it plans to construct a new facility with a processing capacity of 12,000 tons per year. This would add to its existing site, which currently handles 6,000 tons annually, bringing the group’s total capacity in Nigeria to 18,000 tons per year.

However, Hasetins has not provided information on which minerals the plant will produce, where the raw materials will come from, or when construction will begin. It is also unknown whether the $400 million has already been secured, or if it depends on financing from yet-to-be-named investors or lenders.

We have pledged our support for a Foreign Direct Investment (FDI) initiative to establish Africa’s largest rare earth and critical minerals processing plant, driven by a $400 million investment from Hasetins Commodities Ltd in Nasarawa State.

This project represents over 10,000… pic.twitter.com/AIN7tuUxd7

— Dele Alake (@AlakeDele) June 22, 2025

Across Africa, other rare earth projects—at different stages of development—are tracked more openly. These include ventures in Tanzania, Namibia, South Africa, and Angola, mostly led by publicly listed companies that publish regular project updates and resource estimates.

In 2017, Rainbow Rare Earths launched Africa’s first industrial rare earths mine in Burundi. The company’s Gakara project aimed to produce concentrate with a rare earth oxide (TREO) grade of 54 %, using a pilot processing plant. Magnet rare earths, such as neodymium and praseodymium (NdPr), used in wind turbine magnets, represented around 88 % of the Gakara project’s value at the time.

The Gakara mine has been suspended by the Burundian government since 2021, but other projects have gained traction. In Angola, Pensana aims to start production at its Longonjo mine by 2026, targeting 5 % of global NdPr output through mixed rare earth carbonate (MREC). Longonjo is expected to deliver 20,000 tons of MREC per year. In Tanzania, Peak Rare Earths is developing its Ngualla project, which aims to produce 37,200 tons of concentrate per year at a TREO grade of 45 %.

In Nigeria, much remains unknown about the country’s rare earth reserves. The United States Geological Survey (USGS) identified Nigeria as a potential producer back in 2020 but could not provide resource estimates. The USGS reported Nigeria produced 13,000 tons of rare earths in 2024, up from 7,200 tons in 2023, though no details were shared about production sites or whether the mining was industrial or artisanal.

Despite the unknowns, Nigeria is eager to attract investors like Hasetins. The country estimates its mineral wealth at $700 billion but mining contributes less than 1 % to GDP. Officials want to change that, encouraging steel plants, lithium factories, and now rare earth processing projects.

“This project represents over 10,000 new jobs, genuine skills transfer, and a significant step toward processing our minerals domestically,” Minister Alake said after meeting with Hasetins CEO Jidayi Ijudigal. “The Federal Government is fully committed to this project. We will provide all necessary institutional support because initiatives like this bring us closer to our long-term national objectives”.

Nigeria aims to increase mining’s share of GDP from less than 1 % today to 10 % by 2026.

Comments