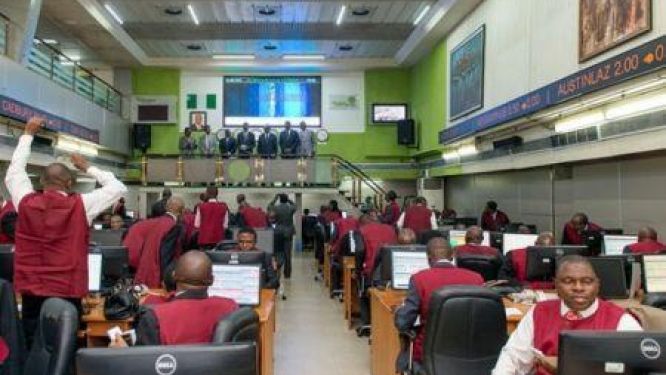

(Ecofin Agency) – After two years on the Lagos Stock Exchange, MTN Nigeria has become one of the fastest-growing assets compared to Dangote Cement. The latter, however, has room for improvement and above all better fundamentals to attract more investors than its stock market rival.

Between May 2019, when it entered the Nigerian Stock Exchange, and March 7, 2022, MTN Nigeria has seen its market value rise by 87.4% to $10 billion. Over the same period, Dangote Cement, which until then weighed more than a third of the stock market valuation of this financial market only evolved by 53.42% to reach $ 11.17 billion.

From a historical and strictly stock market perspective, injecting funds into MTN Nigeria has been a better investment for investors, especially since, given the dividends currently being announced by both companies, the telecom company’s yield on its shares is 6.45%, plus capital gains, compared with 5.85% for the cement company.

MTN Nigeria also wins in terms of return on equity, which is 134.7% compared to 38.9% for Dangote. Similarly, the 2021 revenues of the two companies are announced at $4 billion for the telecom operator and $3.3 billion for Dangote. Gross margins are expected to be 80% for MTN and 60.1% for Dangote.

MTN Nigeria is therefore a dynamic stock that, over the last two years, has offered investors the most attractive stock returns. However, Dangote Cement seems to offer better growth prospects. Several market references support this point of view.

First, the company generates more profit on its sales. Around 26% is converted into net profit, compared with 18.1% for MTN. Another indicator is the leverage ratio, which specifies the proportion of debt to equity in a company. MTN has a rate of 447% while Dangote has 60%.

Finally, the growth in MTN’s value has a speculative aspect, due to investors’ interest in the telecom sector, which is perceived as a generator of funds. Thus, the operator is worth 13.9 times its last reported net profit per share compared to 4.6 times for the cement company. In this configuration, the prospects for growth in market value are more obvious for Dangote.

It appears from recent market indicators that MTN, since it joined the Nigerian Stock Exchange in 2019, has been on a solid upward trajectory, generating more gains and capital appreciation for its shareholders. But on analysis, it has risen too fast and more importantly, with a lower net margin ratio and a considerable debt-to-equity weighting. The safest long-term investment is therefore Dangote Cement.

Idriss Linge

Comments