(Ecofin Agency) – The acquisition project will be completed only after the approval of the Kenyan central bank.

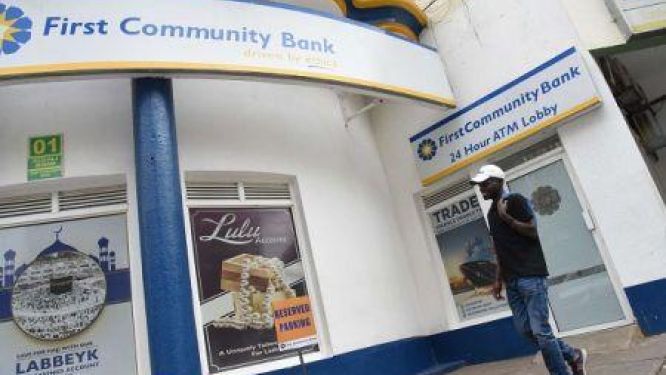

The Competition Authority of Kenya (CAK) approved, last Thursday, the Somali Islamic bank Premier Bank Limited (PBL)’s plan to acquire 62.5% of the Kenyan Islamic bank First Community Bank (FCB).

“ […]it is notified for general information that in the exercise of the powers conferred upon the Competition Authority of Kenya by section 46 (1) of the Competition Act, the Competition Authority of Kenya has authorized the implementation of the proposed merger as set out herein,” a CIB notice informs.

The acquisition process thus set in motion will only be finalized with the approval of the Central Bank of Kenya (CBK). Currently, the amount offered by the buyer is still undisclosed. Once the central bank approves the plan, FCB, which controls 0.02% of the Kenyan banking market with around Ksh 24,701 million ($193 million) in assets (as of December 2021) will be able to merge its operations with those of PBL.

In Kenya, Islamic finance accounts for more than 2 percent of the banking market, and Muslims make up about 15 percent of the population. Kenya has two fully-fledged Islamic banks and several mainstream banks with Islamic windows. This acquisition will support FCB, whose capital base fell to Ksh924 million, below the Ksh1 billion minimum required. Its capital adequacy ratio is 7.1% against the 10.5% minimum required.

The buyer, Premier Bank Limited, is an Islamic bank established in Somalia in 2013. It secured its license in 2014 and became the first bank to launch Islamic finance operations in Somalia.

Chamberline Moko

Comments