Discovery’s head office in Sandton. Image: Boogertman and Partners

Discovery’s head office in Sandton. Image: Boogertman and Partners

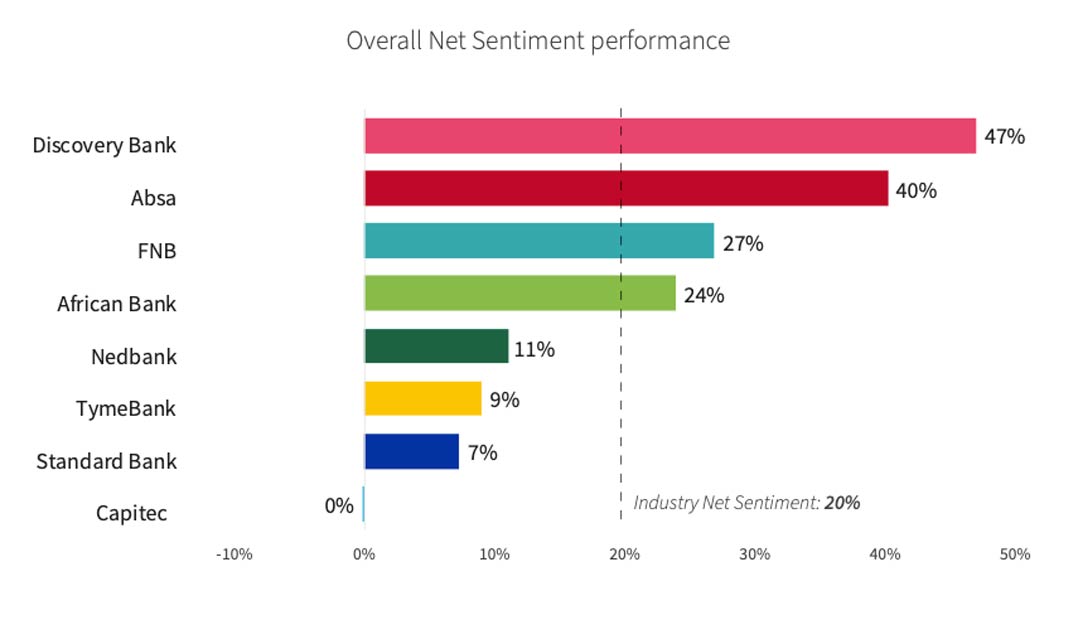

A detailed analysis of more than three million consumer social media posts over the past year shows Discovery Bank is South Africa’s “favourite bank” for 2024.

The research was conducted between September 2023 and August 2024 by DataEQ for its annual SA Banking Sentiment Index, which was published on Wednesday. The reported studies how customers perceive South African banks and is based on 3.3 million social media posts.

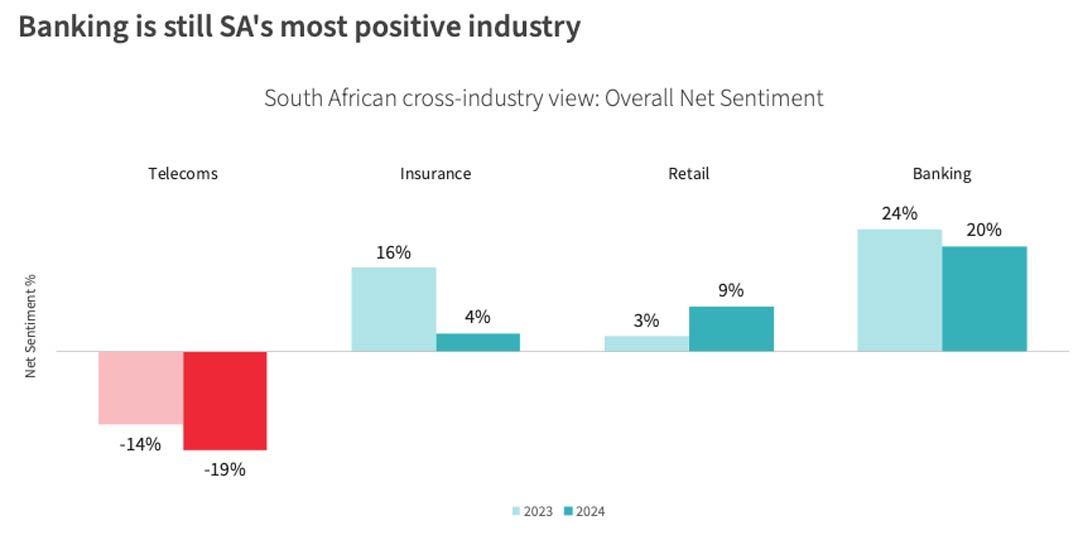

“South Africa’s banking industry continues to lead as the most positively spoken-about industry in the country. Despite a four percentage point decline in Net Sentiment from 2023, the industry maintained an overall positive sentiment score of 20%,” DataEQ said in a statement about the research results.

Customer service remains a significant pain point, with more than 60% of related conversations reflecting dissatisfaction

“This strong performance saw banking outperform the retail, insurance and telecommunications industries according to consumer Net Sentiment,” it said. Among the seven countries analysed by DataEQ, South Africa ranked first in banking Net Sentiment, followed by Botswana, Kenya, Ghana, Saudi Arabia, the United Arab Emirates and the UK.

“Discovery Bank achieved the highest Net Sentiment scores in the overall, operational and reputational categories, cementing its leadership position. Its operational success was underpinned by positive customer feedback, including praise for its customer service, Vitality rewards programme, secure digital platforms and card services.”

Discovery was followed by FNB and Absa in the operational rankings, with both banks earning praise for innovative features and staff service, DataEQ said.

“In reputational rankings, Discovery Bank’s community initiatives, award wins and product innovation solidified its position at the top. Absa and TymeBank followed closely, supported by their strategic partnerships and educational campaigns, which resonated with consumers,” the company said.

Pain point

It’s not all sunshine and roses, though. “Customer service remains a significant pain point, with more than 60% of related conversations reflecting dissatisfaction. Common complaints included long response times, unresponsive service channels and staff competency issues, particularly in call centres,” DataEQ said.

Read: South Africans really don’t like their ISPs

Governance issues also emerged as a critical area of concern, with more than a quarter of industry priority conversations containing a risk theme. “Of this, 54% were linked to perceived downtime issues, including app outages and delayed transactions, significantly impacting customer trust.

None of the banks featured in the report registered a negative Net Sentiment socre. Source: DataEQ

None of the banks featured in the report registered a negative Net Sentiment socre. Source: DataEQ

“Fraud conversations were also a major driver of industry risk, with 14% of all risk-related discussions referencing fraud complaints, including unauthorised transactions and delays in query resolution, highlighting the industry’s struggle to address these risks effectively. The lack of compliance with Treating Customers Fairly (TCF) principles, particularly regarding performance and service issues, further underscored governance vulnerabilities across the industry.”

Telecoms dropped further into negative territory, mainly attributed to network interruptions. Source: DataEQ

Telecoms dropped further into negative territory, mainly attributed to network interruptions. Source: DataEQ

“Governance challenges revealed in this year’s report present a significant risk to the market,” said DataEQ head of client service Sarah Lamb in the statement. “Operational downtime and unresolved fraud issues not only undermine customer trust but also expose banks to potential regulatory repercussions. Addressing these systemic issues is essential for ensuring long-term stability and maintaining the industry’s hard-earned positive reputation.” — © 2024 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here

Don’t miss:

Comments