JPMorgan Chase, the world’s largest bank by market capitalisation, recently announced ambitious plans to expand the company’s footprint in Africa, in a move that an analyst says “is a massive show of confidence in African banking markets.”

Jamie Dimon, CEO of the American lender, travelled to Africa in October, his first trip to the continent in seven years. The trip came shortly after it was confirmed that JPMorgan had secured licences to open new offices in Nairobi and Abidjan. Dimon also visited JPMorgan’s existing African offices in South Africa and Nigeria, where the investment bank offers a range of commercial and investment banking services, as well as asset and wealth management.

JPMorgan has been steadily increasing its exposure to the African market in recent years, despite facing difficulties from regulators both in the United States and in Africa.

Speaking in Abuja earlier this month, Dimon said that he had plans to expand into Africa after the 2008 financial crash, but that he had been prevented from doing so by the US government. “They said banks were risky and didn’t want to add any risks. They were wrong,” he said. Back in 2018, JPMorgan also tried to secure licences to offer banking services in Ghana and Kenya, without success.

New partnerships

Nonetheless, JPMorgan has continued to invest in African markets. In South Africa, for example, JPMorgan has been steadily building its stake in Capitec, the country’s largest retail bank, and is now one of the lender’s biggest single shareholders, owning 8.37% of the group.

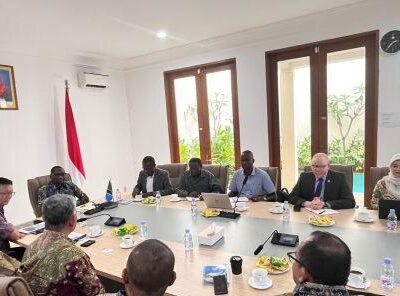

In April this year, JPMorgan also agreed to deepen its partnership with the African Development Bank, with which it collaborates on capital market transactions and local currency financing. Olivier Eweck, JPMorgan’s head of public sector for Sub-Saharan Africa, said at a meeting with AfDB officials that “we are here for the long term.”

“While our work has an impact in periods of prosperity, it is particularly important in more difficult times. We are committed for the long term,” he said.

Given this, it is clear that JPMorgan are bullish on Africa, which the bank’s officials have branded “an amazing growth opportunity.” While on his African trip, Dimon similarly said that “we are quite optimistic about the future of Africa.”

JPMorgan’s move is particularly significant because it comes at a time when other international banks, particularly British and European lenders, are reducing their exposure to the African market or even withdrawing from it altogether. Société Générale, BNP Paribas, Crédit Agricole are just three French banks which have wound down its interests in Francophone Africa in recent years.

Jamal El Mellali, Fitch Ratings’ director covering African banks, previously told African Business that “African markets are higher risk and the level of returns on their subsidiaries, from the French banks’ perspective, are often not enough to justify their presence there.”

The London-based HSBC also announced earlier this month that it would be selling its business in South Africa, in a bid to reduce its exposure to Africa and pivot its focus to target markets in Asia. In August 2022, another British bank, Barclays, sold its remaining 7.4% stake in the pan-African Absa Group, ending an almost century-long presence on the continent.

Gaps in the market?

What explains JPMorgan’s decision to expand its footprint in Africa at a time when many of its global counterparts are doing exactly the opposite? M’khuzo Mwachande, an investment banker in Cape Town, tells African Business that “this development is significant – JPMorgan seems to have seen the French banks leaving West Africa, the British banks leaving Southern Africa, and have concluded that there are gaps in the market to be filled and opportunities to be had.”

“The fact that we have a US bank strengthening its presence in Africa is a massive show of confidence in African banking markets,” he adds. “It gives comfort to the markets in the sense that, despite the regulatory challenges and the challenging macroeconomic conditions, there are still major entities that see potential in providing banking services across the continent. It is not simply the case that everyone is leaving; there is something good to see in Africa.”

Mwachande also suggests that JPMorgan’s move may also have geopolitical motivations. The US’ main strategic competitor, China, has already made significant moves in the African banking market. While JPMorgan has just received approval to open an office in Kenya, for example, the Bank of China has been in Nairobi since 2012.

“There have been lots of Chinese companies operating in Africa, including in banking – and now we have one of the biggest US banks, JPMorgan, also trying to put itself in the best position to tap that market,” Mwachande tells African Business. “I think we are seeing financial services become a new frontier in terms of geopolitical competition.”

Chinese financial institutions have long been trying to leverage their presence in Africa to boost the use of the renminbi (RMB) in bilateral trade and help many African countries achieve their shared goal of diversifying away from the US dollar.

While in Africa earlier this month, Dimon appeared to acknowledge that the US needs to commit greater time, attention, and resources to the continent if it wishes to counter the influence of other powers such as China. “I’m hoping that America plays a healthy part in expanding into Africa,” he said.

Will it encourage others?

It remains to be seen whether JPMorgan’s efforts to expand its presence in Africa will encourage its American competitors to follow suit. New York-based Goldman Sachs has had some success in South Africa, where it provides a range of services targeted at corporates and institutions, and has partnered with the domestic investment bank Investec to provide domestic equity trading services. But whether more American banks will increase their exposure to Africa in the years to come will depend on how commercially successful JPMorgan’s operations on the continent prove to be.

“Banking activity on the part of US banks will not be across the entire continent, but concentrated in a couple of high-growth regions such as East and West Africa,” Mwachande says. “However, I think JPMorgan is definitely setting a precedent for other US banks to pursue interests in Africa.”

Comments