This article is sponsored by Ecobank

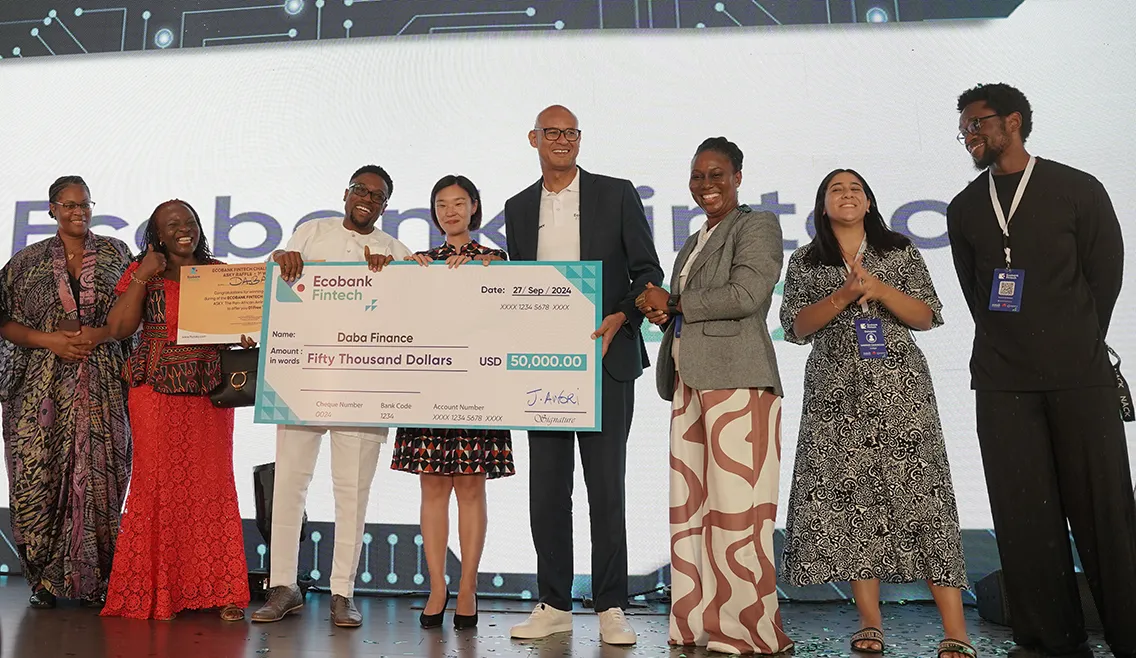

The finals of the seventh edition of the competition, held in Lomé, Togo this September saw Daba Finance, an Ivorian fintech startup offering a one-stop investment platform for trading African securities, emerge as the grand winner from a line-up of 12 impressive finalists.

The finalists were evaluated by a panel of industry experts on criteria such as innovation, market potential, scalability, and team strength. As the winner, Daba Finance clinched the $50,000 prize, while Melanin Kapital from Kenya won $10,000 for second place and Guinea’s fintech YMO secured third place with $5,000.

All of the finalists were enrolled in the prestigious Ecobank Fintech Fellowship programme. This offers valuable exposure to investors and industry leaders, access to Ecobank’s sandbox for testing and developing innovative solutions, and the potential to scale across the bank’s expansive pan-African network.

Hotbed for fintech innovation

“The African continent is a hotbed for fintech innovation globally and is constantly pushing the boundaries to enhance convenience and establish new digitally enabled capabilities,” said Jeremy Awori, Group CEO of Ecobank, at the awards gala.

He highlighted Ecobank’s strategy of leveraging its borderless pan-African digital platform to provide cutting-edge solutions to fintech providers. “At Ecobank, we’re committed to collaborating with these business builders to develop products and services that will benefit our customers and contribute to our continent’s progress,” Awori stated.

He revealed that this year, the bank received a record 1,550 applications from 70 countries in Africa and other global regions. Overall, the awards have drawn more than 7,000 applications since inception.

African Banker spoke to Boum III Jr, CEO and co-founder of Daba Finance, on the significance of winning this award, what inspired him to set out on his entrepreneurial journey in Africa, and his views on the broader fintech ecosystem on the continent.

“Winning is great,” he said in reference to the prize money, “yet, it’s more about what it enables and how it helps us achieve the mission that we have set for ourselves.”

He noted that Daba Finance is leveraging Ecobank’s pan-African network for payments to reach more users across the continent. “Integrating Ecobank’s payment network with our investment solution brings our solutions to the people that need it the most,” he noted.

Improving access to African capital markets

Founded in 2021, Daba Finance offers a platform for investors to access stocks, bonds, and venture capital funds in Africa. “We started with private capital markets but quickly saw the need to cover all asset classes, both private and public,” said Boum.

When it comes to stocks, the platform currently focuses on equities in Francophone Africa and is fully integrated into the BRVM regional stock exchange. For bonds, it offers access to both corporate and government securities. Overall, the platform has managed to sign up more than 20,000 customers and has secured more than $10m in committed investments so far.

Originally from Cameroon, Boum spent five years as a software engineer at Nasdaq and founded a travel tech startup before co-founding Daba Finance with Anthony Miclet in 2021.

“There were key moments that inspired us to build Daba,” Boum explains. His experience at Nasdaq was one such moment, where he learned that most international investors were not tracking African markets, despite the opportunities across different asset classes on the continent. “The lack of exposure to the African market was one of the things that first came to my mind,” he recalls of his time there.

Another pivotal moment was during the Covid-19 pandemic, when Boum was transitioning from his first startup to establish Daba Finance and noticed many African businesses lacked access to capital markets. “Lack of access, information, and the tools to participate in African capital markets inspired us to build Daba Finance,” he noted.

Collaboration will drive fintech growth

Boum highlights deepening collaboration between banks and fintechs as a major trend to watch in African fintech. “Banks play a fundamental and crucial role. They are the incumbents in the industry, and any fintech should adopt a collaborative rather than competitive approach,” he notes. “They hold most of the licences, have an existing customer base and well-established payment networks.”

He anticipates traditional payment services will enhance their offerings by embedding value-added financial services such as lending, investing, and wealth building into their platforms. Collaboration and partnerships will therefore remain key to the success of the fintech ecosystem.

When asked about expanding Daba Finance’s coverage to include equities from other African regions, Boum stated that such an expansion will occur “at the right time”. Currently, he says the focus remains on “listening to the customer” and maintaining a “sound approach” to regulation and compliance. “Our geographic expansion will be based on where we believe we have the right synergy with what we cover already,” Boum concluded.

Comments